How Restaurants Can Benefit from the Employee Retention Credit

The COVID-19 pandemic presented significant challenges to the restaurant industry. Many businesses were required to close their indoor dining facilities and move patrons to outdoor seating while shifting to a takeout and delivery format. Bar services and functions, for a period of time, were not allowed indoors. When indoor dining was eventually permitted, there were capacity restrictions and social distancing requirements that had to be managed. On top of that, restaurants were faced with labor shortages, rising food costs, supply chain delays, and additional health and safety expenditures.

Fortunately for employers in the restaurant industry, the government has provided some measures of relief in the form of Paycheck Protection Program (PPP) loans, Restaurant Revitalization Grants, and the Employee Retention Credit (ERC). This article focuses on the latter and, in particular, two sources of guidance that the Internal Revenue Service recently released.

Employee Retention Credit (ERC) Overview

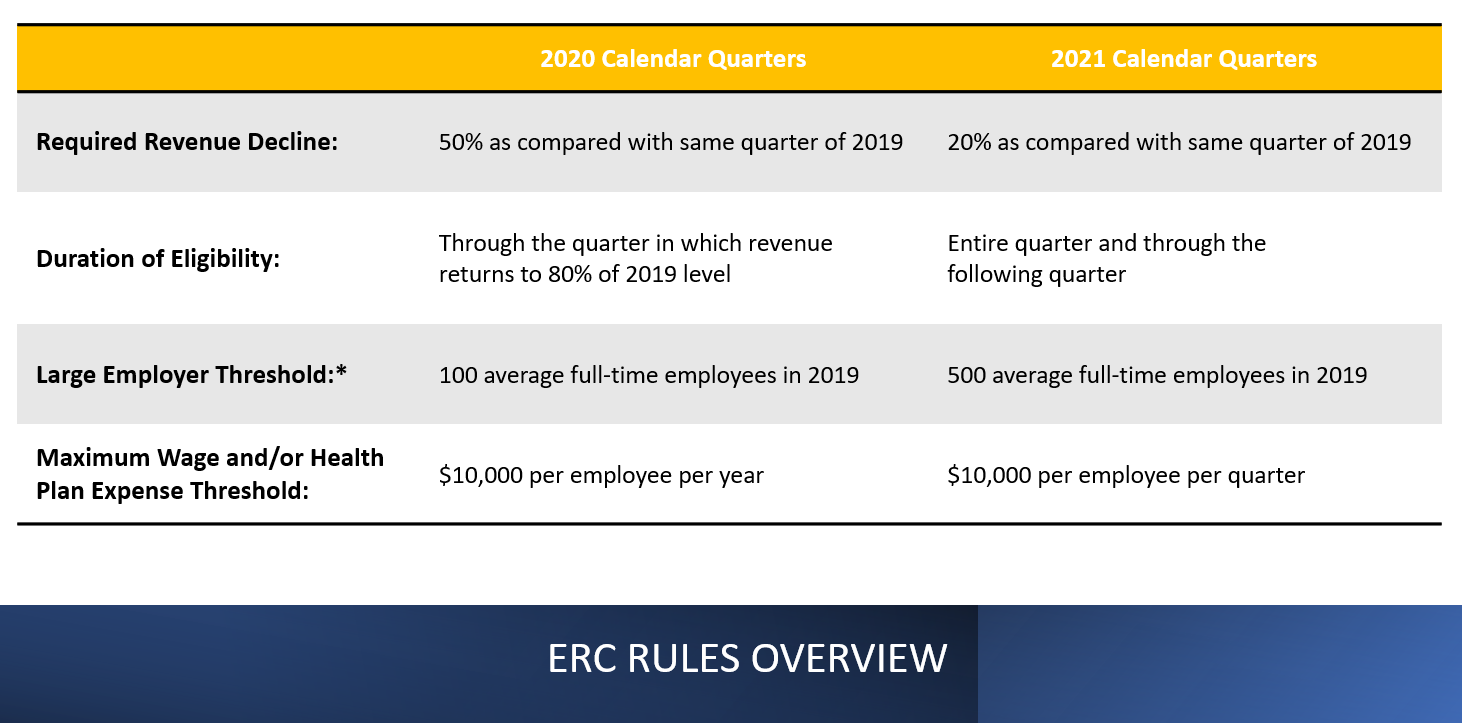

A business may be eligible for the ERC if they were impacted by a full or partial government shutdown or experienced a quarterly revenue decline beyond a certain level. The rules outlined in the table below vary based upon the quarter in question.

*The Large Employer Threshold determines whether all wages paid during periods are credit eligible as opposed to only those paid to employees to not work. For a more detailed review of the credit, consider reading this article published in March 2021.

Notice 2021-49

Notice 2021-49, issued on August 4, 2021, addresses changes made by the American Rescue Plan Act of 2021 by providing guidance to employers who pay qualified wages during the third and fourth quarters of 2021 It also provides clarification for several ERC-related issues that have been sources of uncertainty for businesses and their advisors during both 2020 and 2021.

As it relates to the extension of the ERC through the third and fourth quarter of 2021, nearly all of the guidelines provided in Notice 2021-20 and Notice 2021-23 for the ERC through the first two quarters of 2021 continue to apply. It also introduced a new category of qualifying business: the recovery startup business.

A recovery startup business is an employer that is not otherwise an eligible employer by way of the revenue decline or government shut down requirements that began carrying on a trade or business after Feb. 15, 2020 with average annual gross receipts of no more than $1 million. A recovery startup business would be able to claim ERC up to $50,000 per quarter for the third and fourth quarters of 2021.

Worth mentioning is that the infrastructure bill currently in Congress has proposed a conclusion to the ERC at the end of the third quarter. As it stands now, it is still in effect through the end out the year.

Regarding the clarifications to the existing guidelines, Notice 2021-49 provided the following:

- Tips would generally be treated as qualified wages and eligible for the ERC even if a Section 45B FICA Tip Credit has also been claimed.

- The full-time employee headcount does not require the converting of part-time employees into full-time equivalents.

- The prior quarter revenue decline safe harbor need not be consistently applied to subsequent quarters.

- Guidance provided in Notice 2021-20 related to calculating gross receipts when starting a business in the middle of a quarter also applies to credit calculations in 2021.

- The disallowance of the wage deduction in the amount of the ERC is required to be applied to the tax return in which the wages were paid, regardless of method of accounting or timing of refund receipt.

- Wages paid to > 50% owners and their spouses are only eligible for the ERC in the rare instance that they have no living children or other family members that would constructively own their stock under the requirements of IRC Section 267(c).

The first three clarifications are welcome news to restaurant owners who employ many part-time employees with low base salaries that don’t reach the $10,000 in wages needed to maximize the credit. Prior to this guidance, advisors were uncertain whether part-time employees needed to be converted to full-time equivalents for purposes of the full-time employee head count. Unfortunately, the final two points provide disappointing news, especially to those that may have already filed their 2020 business tax returns or claimed an ERC credit on wages paid to owners and their spouses.

Revenue Procedure 2021-33

On August 10, 2021, Revenue Procedure 2021-33 was issued, and it provided a safe harbor allowing employers to exclude three sources of gross receipts when determining eligibility for the ERC.

These amounts are:

- The forgiven portion of a Paycheck Protection Program (PPP) Loan;

- Shuttered Venue Operators Grants under the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act; and

- Restaurant Revitalization Grants under the American Rescue Plan Act of 2021.

This safe harbor will ensure that businesses, including many restaurants that would have otherwise qualified for the ERC will not be disqualified as a result of the receipt of stimulus funds.

Final Thoughts

Some restaurants have still not pursued the ERC to which they are entitled. With the passing of these two pieces of guidance that addressed nearly all of the questions that remained, there is minimal reason to continue to delay, especially considering the IRS’ lengthy turnaround time in processing the requests. If you have any questions relating to the calculation of the credit or how the modifications will affect your restaurant business, please reach out to a member of our Restaurant and Hospitality Practice.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.