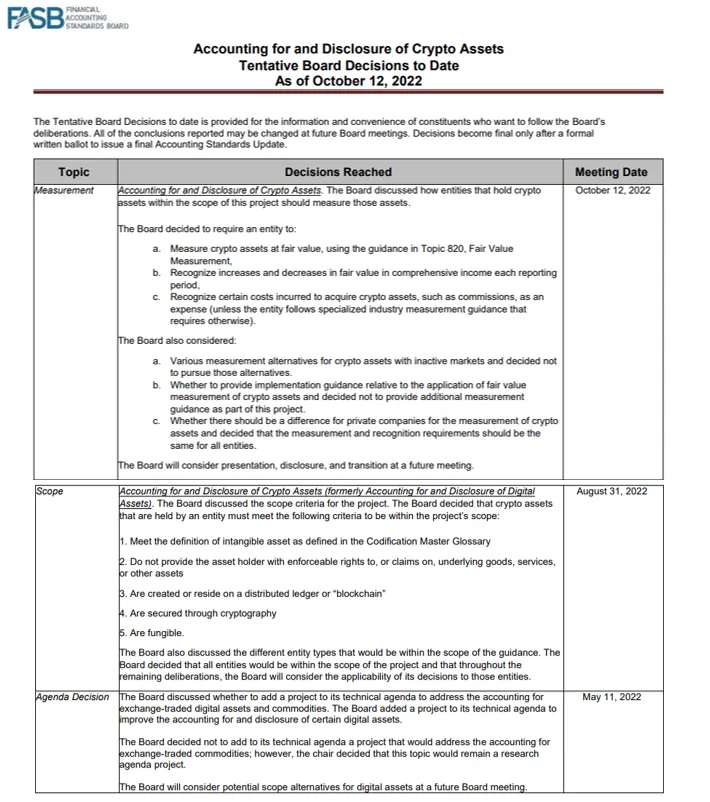

The Financial Accounting Standards Board (“FASB”) recently held a meeting on accounting standard for digital assets. As a result, on October 12, 2022, the FASB announced that they will now require crypto assets to be measured at fair value, as per ASC820. This is a major change for companies that report under Generally Accepted Accounting Principles (“GAAP”). The updated accounting rules still need to be written and approved, but the change is expected to take effect within 6 months. This news is a positive development for investors and digital asset companies to take into consideration.

The Old Rule

Accounting standards currently require companies to report most cryptocurrencies as long-lived intangible assets. This means that they are initially recorded on a company balance sheet at their historical cost. Long-lived intangible assets must then be periodically “tested for impairment” or a diminution in value. In the event that a company finds its long-lived intangible asset has been impaired, the company must record an “impairment charge” as an expense, and reduce the carrying value of the asset. Alternatively, when long-lived intangible assets increase in value, the change is ignored on a company financial statement. This is a strange accounting treatment for a commonly traded asset, such as Bitcoin. The intangible asset treatment required under US GAAP was originally written to address intangible assets such as trademarks, software code, patents, goodwill, etc. It never considered a readily priceable intangible assets such as Bitcoin.

Since write-downs are recorded, and write-ups are not, companies holding digital assets effectively need to report their digital assets at the lowest value since purchase, regardless of any future recoveries or potential recoveries in value. Furthermore, impairment charges need to be tracked lot-by-lot. For example, if a company made 200 different purchases of cryptocurrency, each purchase needs to be separately analyzed and each purchase could potentially cause recognition of intangible asset impairment on the balance sheet. If a particular lot is sold, then the asset impairment for that lot can be removed from the balance sheet. No writeups are allowed for intangible asset under US GAAP.

The New Rule

FASB has not yet written the new accounting standards, so the specifics of this new rule are not entirely known. We do know, however, that most cryptocurrencies will have to be valued on financial statements at “Fair Value” under ASC 820.

Under the fair value standard, there will be no impairment charges. Assets will need to be valued each accounting period, and written up or written down to reflect the fair value of the asset at that time. In their meeting, the FASB decided that these rules should be applied to both private and public companies, and decided against offering any additional guidance on how crypto assets should be valued.

What does this mean for companies with cryptocurrency and investors?

The company’s accounting department will need to think about this asset class differently. They won’t need to periodically test for impairment, nor will they need to record or track impairment charges. The impairment tracking process can be a very time-consuming process, and most cointracking programs do not have impairment charge tracking abilities built in. This will take a lot of pressure off companies that regularly transact in crypto assets.

If a company regularly turns over its coin inventory often, buying and selling regularly, this will likely not have a material impact on their balance sheet or income statement (since all gains and losses are recognized upon disposition). However, this could potentially create large differences for a company that holds cryptocurrency on a longer-term basis. The FASB has said that cryptocurrency gains/losses should be recorded in Comprehensive Income, and therefore the fluctuations in cryptocurrency prices won’t impact a company’s income from normal business operations.

While cryptocurrency prices are at a multi-year low, the impact of this accounting change will be limited (since write downs were always possible for cryptocurrency). But if/when cryptocurrency prices rise, companies will be able to show additional income from their cryptocurrency gains, and additional value from holding appreciated assets. This will make the company financial statements more accurate to the reader, and potentially more attractive to potential investors since the value of their crypto assets will not be artificially deflated.

While this new accounting approach has not yet been implemented, most expect the FASB to finalize and approve the new rules within approximately 6 months. As a result, this will impact company financials starting in 2023 and beyond.

For more information, please reach out to Mark DiMichael at mdimichael@citrincooperman.com or Hemant Behera at hbehera@citrincooperman.com.