How Citrin Cooperman Can Help

Today’s business environment presents new challenges and demands at a more rapidly evolving pace than ever. Financial service firms need clear advice from their accountants and business consultants to navigate new regulatory requirements and meet their tax obligations. In this current climate, it is critical to work with a dedicated team of professionals who understand your unique needs and stay current on the latest industry developments to help your business grow and succeed. We provide services to many businesses in the financial services industry, including:

- Banking

- Broker-Dealers

- Emerging Managers

- Family Offices

- Fintech

- Funds of Funds

- Hedge Funds

- Independent Sponsors

- Management Companies

- Private Equity Funds

- Real Estate Funds

- Registered Investment Advisors

- Registered Investment Companies

- Special Purpose Vehicles

- Specialty Finance Companies

- Venture Capital Funds

Emerging Managers Survey Report

Citrin Cooperman's Financial Services Industry Practice developed the Emerging Managers Survey Report to shed light on the important capital raising and operational issues facing emerging managers. This survey report provides an in-depth analysis of the major factors that are currently shaping, and will continue to shape, future growth for emerging managers, including capital raising, fees and terms, cybersecurity, ESG, and the overall industry outlook. Learn more here.

.webp?h=3300&iar=0&w=2550&hash=79A74816FE79894A0C170DA3C14B64F7)

Private Equity Opportunity Report

In this first ever opportunity report, we explore the opportunities for private equity and venture capital right now. For example, what exit multiples are now considered healthy? Who is planning to raise more capital? How optimistic are boards? What role can technology play in telling a better story to limited partners? The report explores all these topics and more.

Specialty Services

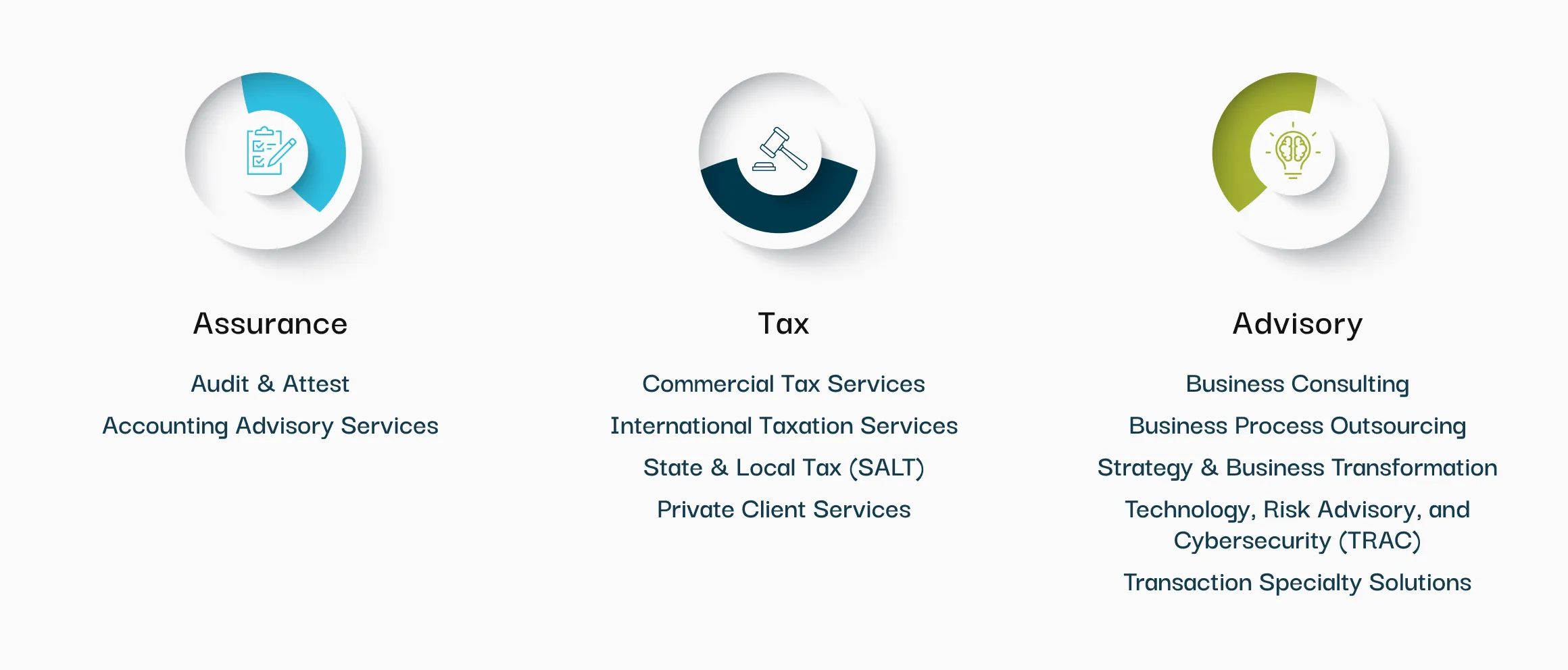

In addition to our core assurance, tax, and advisory services, we also provide:

- Surprise custody examinations

- Performance examination reports

- Audits of financial statements pursuant to SEC Rule 17a-5

- Compliance exams

- Compensation and fee structure agreements

- SSAE 18 System and Organizational Controls (SOC) reports

- Punctual K-1 delivery to partners

- Innovative securities transaction tax planning

- Preparation of partnership economic and tax allocations

- Review of uncertain positions

- Management fee and incentive allocation structure consulting

- Cost allocation studies

- Organizational structure set up

- Regulatory advisory services

Financial Services Leader

View All SpecialistsFinancial Services Insights & Resources

All InsightsContact Us Today

If you are a California Resident, please refer to our California Notice at Collection. If you have questions regarding our use of your personal data/information, please send an e-mail to privacy@citrincooperman.com.

.webp)