2021 ERTC Strategy for Business Owners

Many small and mid-sized business owners got in line to receive their 2nd round of PPP, in the hopes of getting additional funds to run their business. However, before committing to PPP, business owners need to understand the benefits of all federal relief programs, and they should understand the advantages that a program like the Employee Retention Tax Credit (ERTC) has, when compared against the PPP for year 2021.

The IRS still has not provided any authoritative guidance on the new ERTC rules; however, based on the our understanding of the actual legislation, this program is expected to provide significant relief to many businesses, most notably to businesses that employ 500 full-time-equivalent employees or less. Below is a breakdown of the benefits of ERTC on the overlap with PPP. The explanation will help you determine if you are eligible for ERTC, what wages would qualify, how credit is calculated and paid, and how the timing of 2nd draw PPP would impact ERTC. Note that the 2021 computation is different than 2020 so, although you may be eligible for 2020 credits, the below is specific to 2021. Citrin Cooperman will distribute information on how to retroactively apply for 2020 separately, once the IRS issues additional guidance.

Who is eligible for ERTC?

- Have fully or partially suspended operations during any calendar quarter in 2020 due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes)due toCOVID-19;

- "Partial shutdown” can be pretty broad. The IRS includes an example where a governmental order restricting the spacing of tables limits the employer’s indoor dining service capacity and has more than a nominal effect on its business operations. During this period the employer’s business operations continue to be considered to be partially suspended because the governmental order restricting its indoor dining service has more than a nominal effect on its operations.

OR,

- Experience a significant decline in gross receipts during the calendar quarter.

- A significant decline in gross receipts is when the quarterly 2021 receipts are less than 80% of that same quarter in 2019. So as an example, if Q1 2019 sales was 1,000,000 and Q1 2021 sales are 799,999, the employer is eligible.

What are qualified wages?

- If you have 500 full-time-equivalent (FTE) employees (affiliates included) or LESS, any wages paid to an employee during an eligible quarter are qualified, subject to a maximum of $10,000 of wages per employee per quarter.

- If you have MORE than 500FTE employees (affiliates included), any wages paid to an employee during an eligible quarter for time that the employee is not providing services, subject to a maximum of $10,000 of wages per employee per quarter.

- The IRS provides examples where a salaried employee that normally works 40 hours a week is now only working 10 hours a week but at the same salary, is deemed to be not providing services for 30 hours per week.

- Important Notes:

- Employer share of health plan expenses are included in “qualified wages”

- PPP recipients can participate in the ERTC but cannot claim credits on wages that are used for forgiveness. So, you would first calculate your qualified wages, and then pull out payroll costs needed to result in PPP forgiveness

How does the overlap of PPP and ERTC work?

- You can participate in both programs, but wages used to receive PPP forgiveness, cannot be used for ERTC purposes.

- For those with less 500 FTEs or less that are expecting full forgiveness, the later that you begin your covered period, the more payroll you will be able to preserve for ERTC.

- As a very simple example, if you have 1 employee that earns $30,000 per year and you receive aPPP loan of $7,000 on 2/1/2021. The total wages paid between 1/1/2021 and the end of my covered period (7/19/2021; 24 weeks following the 2/1/2021 disbursement date) would be $16,000 (about 28 weeks). If you use $4,200 of payroll to obtainPPP forgiveness (60% ofPPP), $11,800 of wages available fromERTC, resulting in a refundable credit of $8,260 when combining both quarters.

- Let’s change the example so that the PPP loan of $7,000 is received on 3/1/2021. The total wages paid between 1/1/2021 and the end of the covered period (now brought out to 8/16/2021) would be $18,500 (about 32 weeks). If you use $4,200 of PPP on payroll to obtain full forgiveness (60% of PPP), which would leave $14,300 of wages available for ERTC, in the result is a refundable credit of $10,010 when combining both quarters.

- By moving the PPP covered period from 2/1 to 3/1, you can generate an additional $1,750 of ERTC for this 1 employee. If you were to extrapolate these numbers to a business that has 200 employees, a 2/1/2021 loan date would generate 1.65 mil in ERTC versus a 3/1/2021 loan date which would generate $2 mil – an increase of $350,000.

- From a purely financial perspective, it would make most sense to wait to begin yourPPP covered period. The risk to this strategy is:

- The SBA runs out of money and does not replenish

- Your delaying cash inflows from PPP

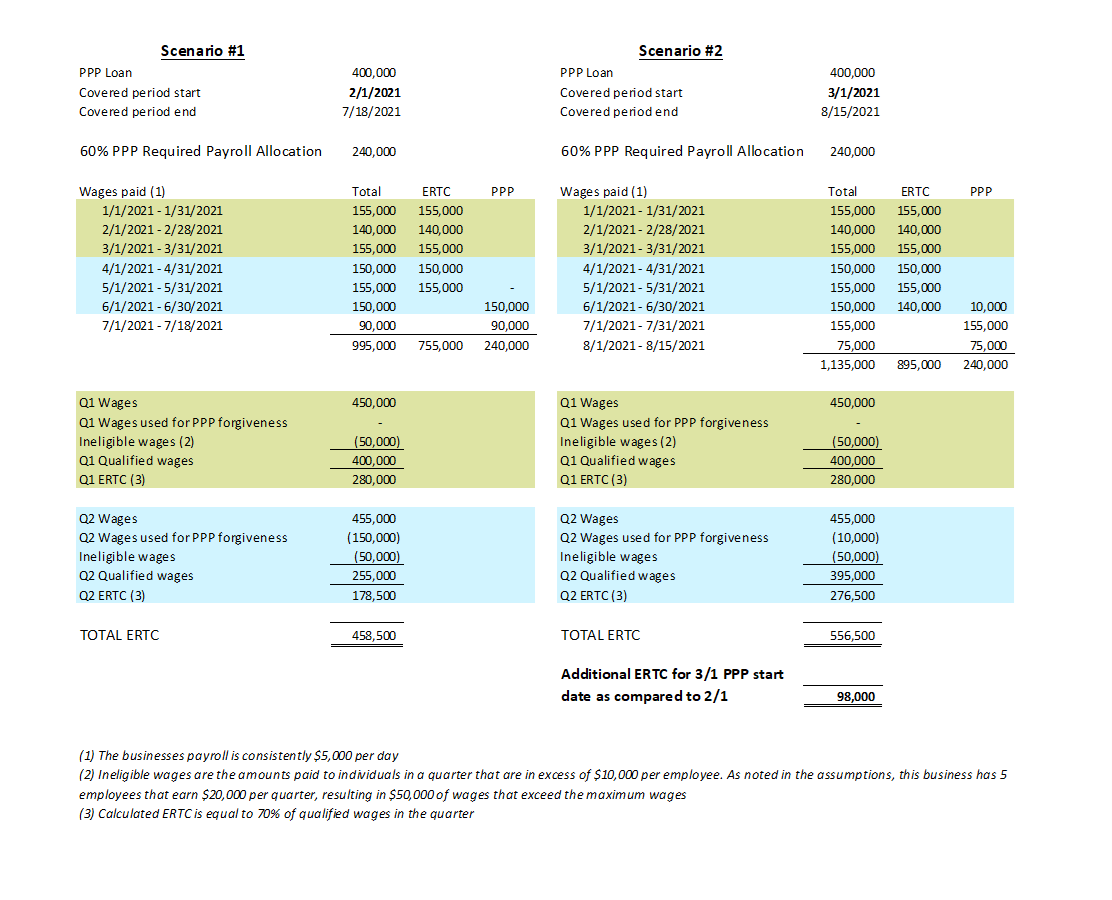

It may be difficult to understand the above narrative, so to help make sense of the numbers, the illustration below shows the impact of ERTC credits for a business that applies for PPP on 2/1/2021 as compared to 3/1/2021. The following assumptions have been made for the purposes of this illustration:

- The business is eligible for a 2nd draw of PPP and ERTC for Q1 and Q2 2021

- The business has consistent payroll in 2021 of $5,000 per day and does not have any healthcare costs to add

- The PPP loan received was $400,000

- The business has 5 employees that earn $20,000 per quarter. Every other employee earns less than $10,000 per quarter

- The business has less than 500 full-time-equivalent employees

Illustration of ERTC Overlap

The illustration demonstrates that, by starting the PPP covered period on 3/1, you are able to preserve more wages for ERTC, amounting to $98,000 in monetizable dollar-for-dollar credits. This model essentially results in $3,000 of additional ERTC for every day that the borrower delays the start of their PPP covered period.

To reiterate, holding off on your PPP application is not the right solution for someone who either can’t afford to wait an extra day, or someone who is fearful that the program funds will be exhausted before they apply. However, for those who can tolerate the risks, there could be significant dollars made available to them by strategizing the start date of their PPP covered period.