California Signs AB 80 Into Law

On April 29, 2021, Governor Gavin Newsom signed AB 80 into law, bringing California into partial conformity with the federal rules regarding deductibility of expenses paid from Paycheck Protection Program (PPP) loans.

Previously, California law excluded forgiven PPP loans from income but disallowed deductions for expenses paid from PPP loan funds. AB 80 amends California Revenue & Taxation Code (R&TC) Sections 17131.8 and 24308.6 to allow certain individuals and corporations to deduct expenses paid from PPP loans. Ineligible taxpayers include:

- Publicly-traded companies

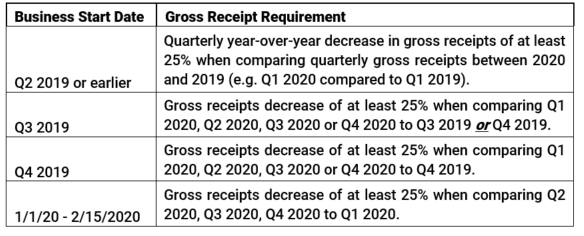

- Taxpayers that do not meet the gross receipts requirements of Section 311 of Public Law 116-260. Taxpayers satisfy the gross receipts requirement by demonstrating a decrease in gross receipts as follows:

AB 80 also modifies R&TC Sections 17131.8 and 24308 to provide that Economic Injury Disaster Loan advance grants received under the CARES Act and the Consolidated Appropriations Act are not included in gross income.

Should you have any questions, please reach out to your Citrin Cooperman advisor or Tri Hoang at thoang@citrincooperman.com.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.