Do You Understand the Changes to Lease Accounting Standards?

As seen in the Boston Business Journal

In February of 2016, the Financial Accounting Standards Board (FASB) issued the Accounting Standards Update (ASU) 2016-02, Leases, which significantly changes the way leases are accounted for on the financial statements of lessees. The ASU also includes changes to accounting for leases in the financial statements of lessors to conform and align with the new revenue recognition guidance.

The new lease accounting standard is a result of the FASB wanting more transparency and comparability among companies. To do so, they will now require all leasing arrangements to be recognized on the balance sheet as a lease asset and a lease liability in the financial statements of lessees. Any company with operating leases under the current accounting standards, which are considered off-balance sheet financing, will now be required to record those leases as a Right of Use (ROU) asset, with a corresponding lease liability, as the entity has a right to use the underlying asset for the lease term. Additionally, there will be increased disclosures required in the notes to the financial statements to further increase transparency.

Leasing arrangements are made to gain access to assets, obtain financing, or reduce exposure to the risks of ownership of an asset. Topic 842 defines a lease as a contract, or part of a contract, that conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration.

Not all leases will be apparent as such, because a lease can be “part of a contract”. The evaluation will be more complicated when an arrangement involves both a service component and a leasing component (i.e., an embedded lease).

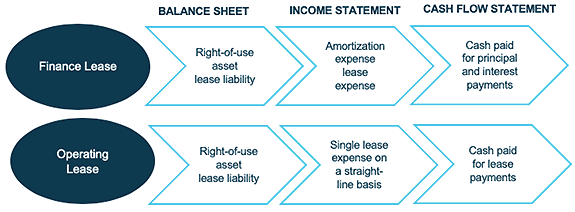

Lessee accounting treatment has been updated as follows:

In addition, the new lease standard significantly increases the required lease disclosures. Entities should take the disclosure requirements into consideration early on to ensure they understand them and are prepared. The objectives of the disclosures is to enable financial statement users to assess the amount, timing, and uncertainty of cash flows arising from leases. It is important to note that there are no differences in disclosure requirements for public and private companies.

Topic 842 requires entities to identify the lease components, non-lease components, and other items that are not considered contract components. Identifying these elements is important because consideration in the contract is allocated only to the lease and non-lease components.

Although this requirement does not differ from that under existing U.S. GAAP, the effect of not applying this requirement correctly under Topic 842 is more significant because most leases must be recognized on the balance sheet under the new guidance.

The new guidance is effective at different times for different entities:

- For public entities, certain not-for-profits, and employee benefit plans that file financial statements with the SEC (this includes interim periods within those fiscal years) effective for years beginning after Dec. 15, 2018

- For all other entities effective for years beginning after Dec. 15, 2019

- For all other entities for interim periods effective for years beginning after Dec. 15, 2020

There is the opportunity for early application for all entities.

The most important thing companies need to do is start a dialog with accountants, creditors, and investors on how these changes will impact financial reporting. The next step is gathering all lease contracts and testing them to determine if they meet the criteria of a lease, and which category of leases they fall under.

Management will need to analyze lease contracts for remaining terms, renewal options, future payments, and interest rates, if applicable. At this stage, management will need to prepare estimated journal entries to move operating leases onto the balance sheet and analyze the impact of the adjustment on key metrics and debt covenants.

In transitioning to the new accounting standard, entities are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach.

Using this information, management will need to make decisions on whether a company should buy versus lease assets, execute short-term versus long-term leases, or whether it is possible to include substitution clauses in lease contracts.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.