Guide to U.S. Federal Reserve Main Street Lending Program

On April 9, 2020, the U.S. Federal Reserve launched a $600 billion lending program aimed at helping relieve the liquidity crisis facing many small and medium-sized businesses in the aftermath of the COVID-19 pandemic.

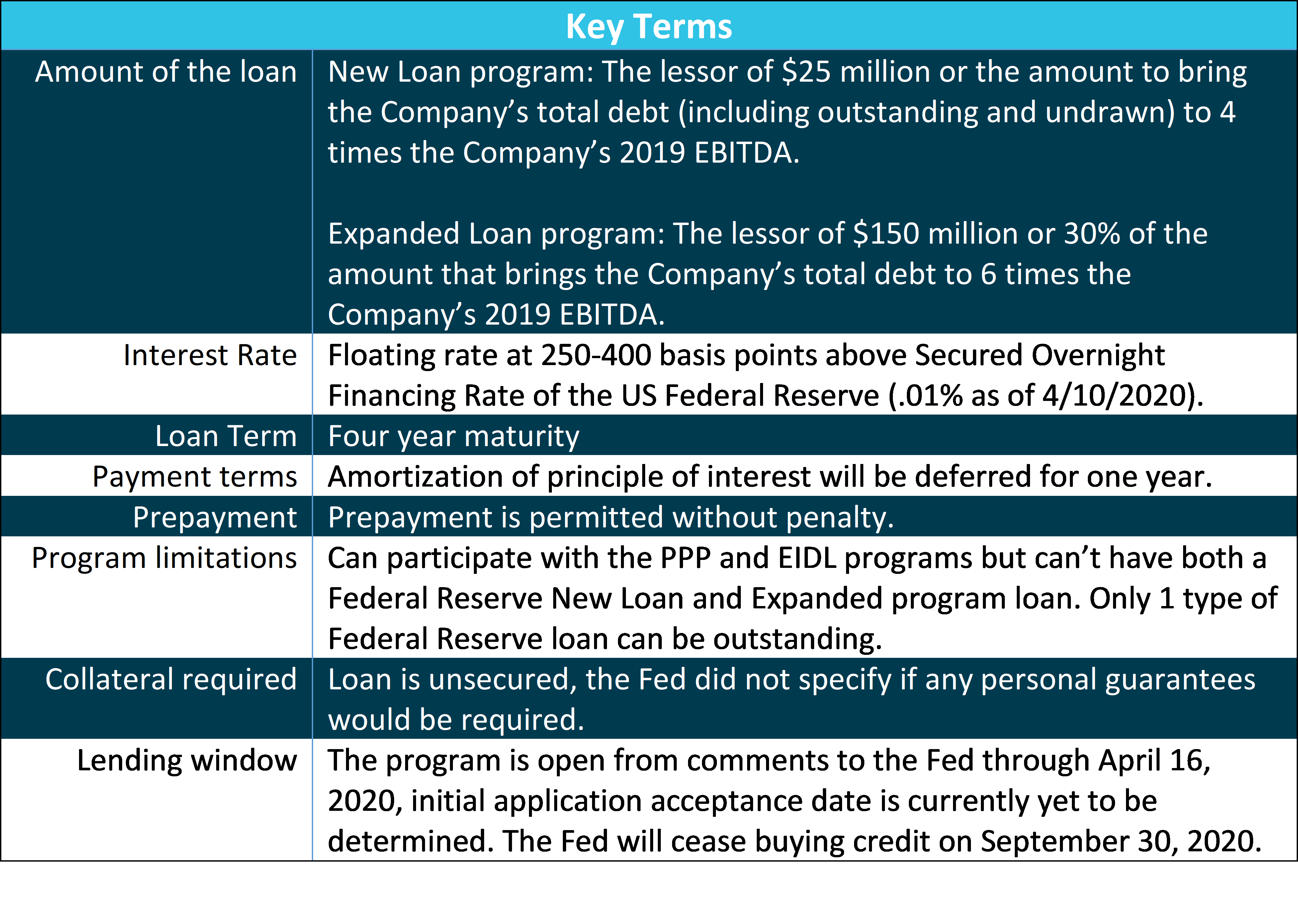

The Main Street Lending Program (Main Street) offers four-year, unsecured loans to businesses that meet the criteria set forth by the Federal Reserve. The program allows businesses to take part in both this program and the Small Business Administration’s Paycheck Protection Program (PPP), however, unlike the PPP, the Main Street loans are not eligible to be forgiven, but principle and interest payments are able to defer for one year. When the program is finalized (comment period expires April 16), eligible banks may originate new loans through the Main Street program or use Main Street loans to increase the size of existing loans to businesses.

In order to qualify for the program, the business must meet the following criteria:

- Have 10,000 or fewer employees or $2.5 billion or less in total 2019 annual revenue.

- Be a business created or organized in the United States, or under the law of the United States, with significant operations in and a majority of its employees based in the United States.

- Have minimum borrowings of $1,000,000

- Have maximum borrowings, defined as:

- For new loan agreements under the Main Street New Loan Facility, the lesser of $25 million or:

- An amount that, when added to the borrower’s current outstanding and committed but undrawn debt, does not exceed four times the borrower’s 2019 earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Forupsizing existing credit facilities under the Main Street Expanded Loan Facility, the lesser of $150 million or:

- 30% of the eligible borrower’s current outstanding and committed but undrawn debt, or an amount that when added to the borrower’s current outstanding and committed but undrawn debt, does not exceed six times the borrower’s 2019 EBITDA. The Federal Reserve loan will be considered a separate tranche under the modified debt facility.

- A borrower cannot participate in both the New Loan and Expanded loan programs provided by the Federal Reserve but can participate with other programs such as the aforementioned PPP loans from the SBA.

- For new loan agreements under the Main Street New Loan Facility, the lesser of $25 million or:

- The originating lender will retain 5% of the loan and the U.S Federal Reserve will purchase 95% of the loan from the originating lender, up to $600 billion over the course of the program.

Required attestations of the borrower are as follows:

- The borrower must attest that it required the loan due to exigent circumstances brought on by the economic impact of the COVID-19 pandemic and that, using the proceeds from the loan, will make reasonable efforts to maintain its payroll and employees during the term of the loan.

- The borrower cannot use the proceeds of the loan to repay other loan balances and refrain from paying other debt of equal or lower seniority, with the exception of mandatory principal payments, until the Main Street Lending loan has been paid in full.

- The borrower will not try to cancel or reduce any of its outstanding lines of credit with any lender.

- The borrower must attest that it meets the EBITDA leverage conditions noted above.

- The borrower must follow the compensation, stock repurchase, and capital distribution restrictions that apply under the CARES Act of 2020 for the duration of the loan and the 12 months following the repayment of the loan. These include:

- If publicly traded, the borrower cannot repurchase an equity security unless under certain terms.

- May not pay dividends or make other capital distributions with respect to the common stock of the borrower. Note: at the time of initial release the Federal Reserve did not make any provisions for pass-through entities and tax distributions.

- For officers or employees with total compensation in excess of $425,000 during calendar year 2019, compensation is capped at what was received during 2019 for the term of the loan.

- Severance pay or other benefits received upon termination shall not exceed twice the total compensation of the officer or employee received during calendar year 2019.

- For officers or employees with total compensation in excess of $3 million in calendar year 2019, compensation is capped at up to $3 million and 50% of any compensation in excess of $3 million received during calendar year 2019 for the term of the loan.

- Lenders and borrowers will both need to certify that they are eligible to participate in the program and be in compliance with the conflict of interests prohibition as defined in the CARES Act.

- Currently, non-bank lenders are not eligible to serve as lenders under the terms of the program.

- The lender is required to pay the Federal Reserve a facility fee of 100 basis points (1%) of the principle amount of the loan participation purchased by the Federal Reserve (95% of the loan). Lenders may require this fee to be paid by the borrowers in addition to any other debt servicing fees.

- The Facility will terminate on September 30, 2020 when the Federal Reserve ceases purchasing its component of eligible loans.

https://www.federalreserve.gov/monetarypolicy/mainstreetlending.htm

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.