New Lease Standards Can Significantly Impact Restaurants

THE BOTTOM LINE:

New Lease Standards Can Significantly Impact Restaurants

As seen in March/April 2019 Issue of NIBBLES

New lease accounting standards, known as Accounting Standard Codification Topic 842 (“Topic 842”) for GAAP Financial Statements will become effective for private companies for years beginning after December 15, 2019. The new lease accounting standards will bring substantial changes to the way lessees account for leases. Because of their need for prime location spaces and high amounts of equipment investments, restaurants could be significantly impacted, once the new standard goes into effect. The impact will depend on your restaurant’s use of leases.

Leases and Lease Reporting

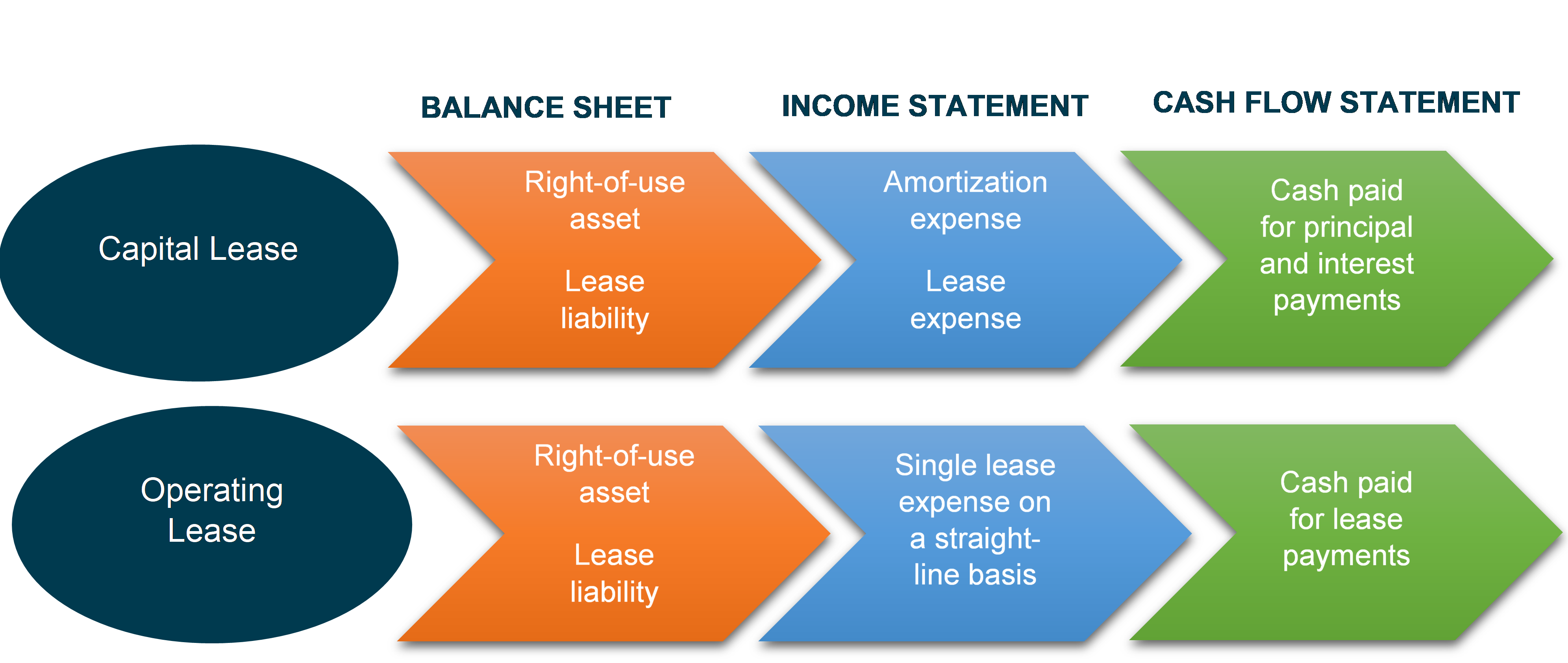

Leasing arrangements provide access to assets, help obtain financing, or help reduce exposure to the risks of owning an asset. Under current accounting standards, lessees have two lease reporting options. The first reporting option is known as a capital lease, which is capitalized on the balance sheet. The second reporting option is an operating lease, which is recorded on the income statement and disclosed in the notes to the financial statements. The new lease accounting standards will require all leases[1] to be recorded on the balance sheet (with some exceptions) as a Right of Use (“ROU”) asset and a corresponding lease liability, since the lessee has a right to use the underlying asset for the term of the lease.

Topic 842

Topic 842 is meant to provide a more complete picture of lessees’ true liabilities. Topic 842 defines a lease as a contract, or part of a contract, that conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration. For every long-term lease – defined as a lease contract with an original term of more than 12 months – the lessee will now have to determine the amount of its lease liability using a discounted cash flow methodology

The Impact on Restaurants

Current operating leases provide organizations with assets, without affecting its debt/liabilities. The new lease standards add liabilities to the books, and may impact a restaurant’s debt covenants, taxes, and internal operations, as well as key performance metrics, including; leverage ratio (debt/equity); current ratio (current assets/current liabilities); and, debt to earnings before income taxes, depreciation, and amortization (“EBITDA”). Since lessees are adding the ROU assets to the balance sheet, it could also affect book to tax differences and personal property taxes.

From an operations perspective, owners will need to consider the impact of lease versus buy decisions, because restaurants will no longer have the benefit of an off-balance sheet financing option. Additionally, owners would need to consider whether to execute short term versus long term leases, or whether it is possible to include substitution clauses in lease contracts.

How to prepare

Restaurant owners who report their financial results using GAAP should begin the process of identifying lease agreements that may be impacted by this change. The most important thing restaurant owners need to do is start a dialog with accountants, creditors, and investors on how these changes will impact their financial reporting. Some of the next steps will include the following:

- Gathering all lease contracts and testing them to determine if they meet the criteria of a lease, and which category of leases they fall under.

- Analyze lease contracts for remaining terms, renewal options, future payments and interest rates, if applicable.

- Prepare estimated journal entries to move operating leases onto the balance sheet and analyze the impact of the adjustment on key metrics and debt covenants

Bottom Line

This new financial reporting requirement will affect the decisions that restaurant owners should make when entering into leases. Considerations should be carefully analyzed in order to determine the implications of the new lease standards to key performance metrics, debt covenants, taxes, and internal operations. Each consideration will have its advantages and disadvantages. In order to prevent the new lease accounting standards from affecting the economics of your restaurant, or more importantly the bottom line, both communication and planning needs to begin well in advance of the implementation date.

[1] Note that not all leases will be apparent because a lease can be part of a contract (i.e., an embedded lease, which includes a services contract).

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.