Summary of Individual Provisions of CARES Act

Recovery rebates will be sent to individuals in the following amounts:

- $1,200 per person/$2,400 to married couples and

- $500 per dependent child under age 17

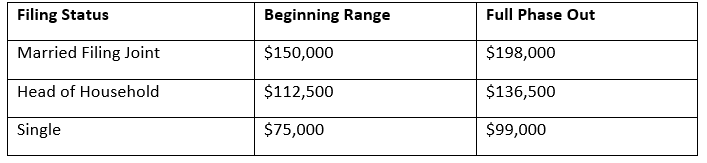

- Amounts will be phased out over the following ranges

- Determination made based on 2019 Adjusted Gross Income if return filed. Otherwise, 2018 will be used. If no returns filed, Social Security or Railroad Retirement benefit statements will be used.

Treasury Department was directed to provide these rebates as soon as possible.

Retirement plan distributions of up to $100,000 can be taken during 2020 without penalties if the participant or spouse is diagnosed with the Coronavirus or has experienced adverse financial consequences as a result of being quarantined, furloughed, laid off or had hours reduced.

- Any distributions can be repaid within three years and will not be subject to taxation.

- Amounts not repaid will be included in taxable income over a three year period.

- In lieu of distributions, loans of up to $100,000 from plans can be taken.

Required Minimum Distributions from IRAs or 401(k) plans that are required to be made in 2020 can be waived. This includes distribution required to be made by April 1, 2020 because the account owner turned 70 ½ in 2019.

Charitable Contribution deduction limitations have been relaxed for 2020. For non-itemizers, a $300 “above the line” deduction is allowed for cash contributions. For itemizers, the 50% of adjusted gross income limitation on charitable contributions has been suspended for 2020.

Employer Payment of Student Loans in 2020 can be excluded from an employee’s income subject to the overall $5,250 limits on employer sponsored educational assistance programs.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.