The Ten Newest Updates to the Restaurant Revitalization Fund

In our article, “What’s on the Menu for Saving Restaurants: Part 1” we discussed the key elements of the Restaurant Revitalization Fund (RRF), a new grant program included in the American Rescue Plan Act of 2021. On April 13, 2021 the Independent Restaurant Coalition (IRC) hosted a town hall, joined by members of the Small Business Administration (SBA), to share the latest on the RRF application process. The session provided more information on grant eligibility, timeline, and fund distribution for restaurant operators. Here are ten important RRF updates for restaurant owners:

- The covered period has been extended until 3/11/2023.

- You are not required to register for a DUNS number and sam.gov registration to complete the application process. Applications and additional guidance will be available on restaurant.SBA.gov (applications are not open as of the date of this publishing). There will be a pilot period for seven days before they go live.

- If you have applied for the Shuttered Venue Operators Grant (SVOG) you are ineligible to apply for the RRF.

- Priority groups have the first 21 days to apply, once the application process opens up.

- To be considered a priority group 51% of the total investors must be women, veterans or the business needs to be socially and economically disadvantaged. The groups can be mixed and matched. For example, you have five partners who are 20% owners and two are women and one is a veteran, the total of those equate to 60%; thus, you are above the 51% to be eligible for the priority group.

- Current documents to gather:

- Tax returns for 2019 and 2020, if available

- Bank statements

- Point of sale reports

- Profit and loss reports for 2019 and 2020

- You are required to authorize the SBA to receive the Form

4506T, Request for Transcript of Tax Return

- Economic Injury Disaster Loans (EIDL) do not get included as gross receipts.

- If you received a Paycheck Protection Program (PPP) loan, the RRF funds will be less the PPP funds. However, principal and interest payments on debt (including SBA and PPP loans) are an eligible cost.

- Maximum grant is $5 million per individual restaurant and $10 million per restaurant group with not more than 20 locations.

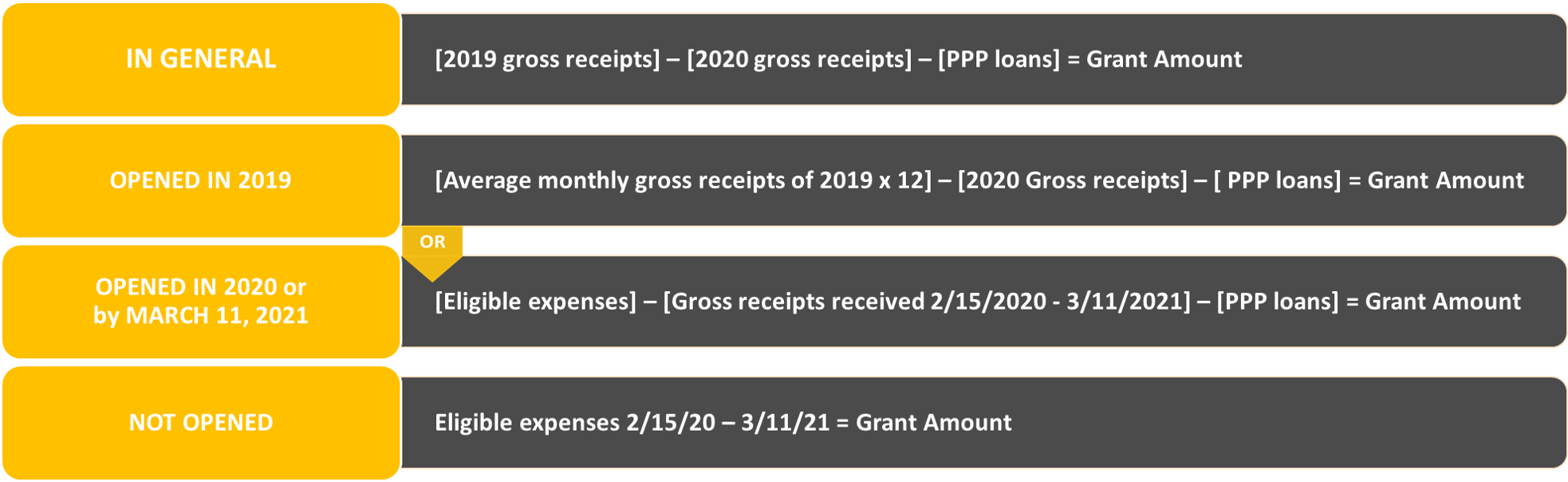

- The following calculations can be used to calculate your grant amount:

Our advice is to gather all your documentation as soon as possible to be ready to apply once the applications open. The RRF is a great win for the restaurant industry, but not everyone will receive funding, as $28.6 billion may not be enough to meet the demands of the industry. There is a chance that Congress might replenish the funds if there is a high demand, but this is not a certainty, thus haste and preparedness is key.

Please reach out to the authors or your Restaurant & Hospitality Practice professional for more information. You can also browse through related topics on our Restaurant & Hospitality Content Hub.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.