Limiting Staff Doesn’t Have to Mean Limiting Sound Financial Practices

Cash management in the age of COVID-19

When the COVID-19 global pandemic hit the United States, the shift to business closures and work from home policies was swift. In the process, a number of business practices of many small and mid-sized businesses had to pivot to function in the new reality. As a result, resilient businesses may see changes in how their accounting processes and personnel function that last well beyond the pandemic. Still, even during this emergency, proper controls remain essential to guard against fraud or error in financial activity and reporting.

Unfortunately, many businesses were forced to reduce their workforce, including some members of the administrative and accounting teams. These businesses have adjusted their procedures to ensure that customers are invoiced, cash is received, and bills are paid. With a smaller staff, there may be some situations where there is an inability to effectively achieve proper segregation of duties. Nevertheless, businesses can compensate for that by instituting appropriate approvals, proper monitoring, and systematic reconciliation of controls with the appropriate levels of management overseeing these functions.

To illustrate this, suppose that, previously, a senior accountant prepared the bank reconciliation each month, but the company no longer employs that person. One way to mitigate the risk in this situation is to have the CEO routinely inspect the bank transactions, online, to ensure all transactions are appropriate for the business.

To operate effectively in a remote environment, some businesses may have had to streamline processes. For example, a business may request customers make payments through an electronic method such as EFT (Electronic Funds Transfer) or wire, ACH (Automated Clearing House), or credit card rather than mailing checks to the business office. Using such payment methods helps reduce errors, saves valuable resources, and provides much greater security than transactions made with paper checks. Such payments can also help you manage cash flow by allowing you to schedule the timing of payables and receivables to best benefit your business and to optimize profits.

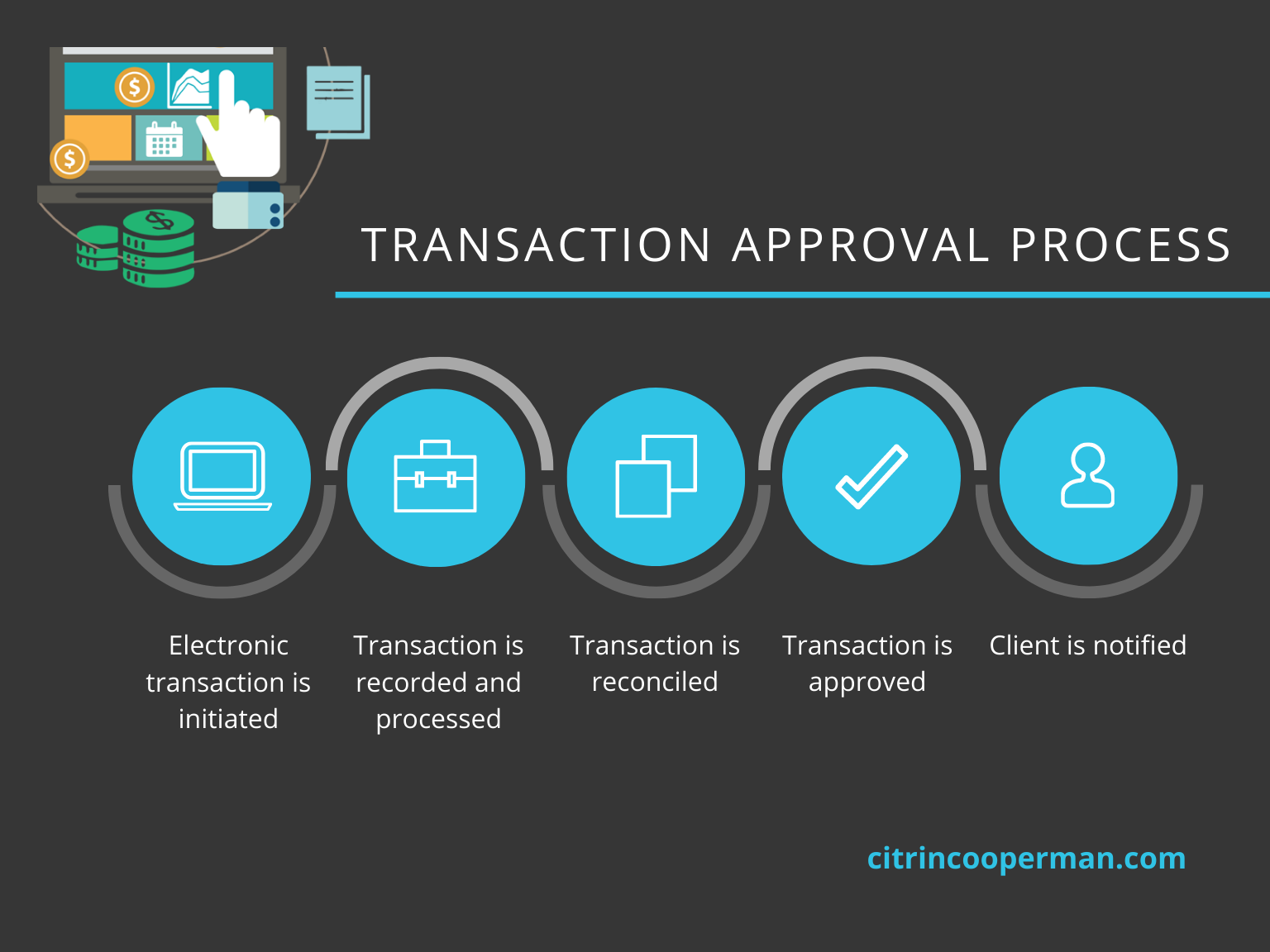

A company can also establish a lockbox account with the bank, letting the bank handle the check processing for the business. The company may also consider some of these same methods to pay its bills, making sure to establish a proper approval trail, such as copies of emails indicating approvals and so forth. Because paying electronically sends and tracks transactions in real time, the long process of reconciling payments associated with paper checks or credit cards is completely eliminated. Since payment is transferred from your banking account to the recipient’s banking account, the debit is reflected almost immediately.

Controls over cash transactions and cash management are ever more critical, so even if your team has been reduced and is now working remotely, finding ways to mitigate the new risks is more important now than ever. We hope that we can all get back to business soon, but in the meantime, don’t risk your business further by failing to implement controls.

|

|

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.