New Tax Law to the Rescue – Two Provisions Potentially Beneficial for Staffing Companies

2020 was a year fraught with many challenges to business owners, attributable to COVID-19. Fortunately, the year ended on a positive note for those business owners, including staffing companies, with the passage of a bill designed to address some of those challenges. On December 27, 2020, the Consolidated Appropriations Act, 2021 (“CAA”) was signed into law, which, in addition to other general COVID-19 stimulus measures, provides for a second round of Paycheck Protection Program (“PPP”) lending administered under the Economic Aid Act, and extends and modifies the Employee Retention Credit (“ERC") program that was administered under the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Approximately $285 billion has been allocated to restart and expand the PPP. Funds are available to eligible borrowers who are either seeking to obtain or amend their first PPP loan, known as a ‘first draw’ loan, or have previously received a first draw loan and are seeking to get a second PPP loan, known as a ‘second draw’ loan. The CAA now makes available the ERC to companies that have received or plan to receive a PPP loan. We will touch on the second draw loan and the changes to the ERC.

A second draw may not exceed the lesser of $2 million or 2.5 times the average monthly payroll costs during either (i) the one-year period before the date the loan was made, (ii) 2020, or (iii) 2019, whichever the borrower elects to use. For seasonal employers, the average monthly payroll costs can be based on any 12-week period between February 15, 2019 and February 15, 2020. The borrower must have used, or will use, the full amount of its first draw loan, on or before the date that the second draw loan is disbursed. This does not mean that the first draw loan needs to be fully forgiven but the borrower must have spent the first draw funds on eligible expenses, as defined in the CAA and subsequently issued Interim Final Rules (IFRs). Borrowers have until March 31, 2021 to submit their applications for second draw loans.

The criteria for eligibility for second draw loans are stricter than those associated with first draw loans. With certain exceptions, the maximum number of employees has been reduced from 500 to 300, and affiliation rules still apply. Unlike the first draw loans, industry and alternative size standards likely do not apply, which might result in some staffing companies being ineligible for second draw loans. There is now a requirement that the borrower experience at least a 25% decline in gross receipts when comparing any one quarter of 2020 to the corresponding quarter of 2019. The borrower must factor the gross receipts of all its affiliates when calculating the 25% quarterly reduction. Gross receipts include revenue received or accrued, measured in accordance with the entity’s accounting method. Finally, second draw borrowers will need to certify that economic uncertainty makes the loan request necessary to support the ongoing operations of the entity.

The terms of full forgiveness for a second draw loan remain similar to those of first draw loans. The qualifications are contingent upon the borrower maintaining the same level of full-time equivalents as required for the first draw reference periods, and at least 60% of the proceeds having been spent on payroll costs. Although most staffing companies should be able to satisfy the eligible cost requirement with payroll costs, it is worth noting the CAA has expanded the definition of qualifying non-payroll costs to include expenditures related to operations, property damage, covered supplier costs, and covered worker protection expenditures. Specific examples of eligible expenses under these new categories have not been provided and will likely be addressed in future IFRs and FAQs.

The ERC is a refundable tax credit against certain employment taxes. Under the CARES Act, businesses were not eligible for the ERC if they participated in the PPP loan program. Fortunately, the CAA has removed this restriction as PPP borrowers may now also claim the ERC, provided they meet other criteria. One limitation on the use of the ERC is that eligible wages used to meet the 60% payroll threshold for PPP loan forgiveness cannot also be used for the ERC. This incentivizes companies looking to take advantage of both the PPP and ERC to maximize the non-payroll costs for PPP forgiveness and make more eligible payroll available for the ERC.

Companies are entitled to claim the Employee Retention Credit if they are private-sector businesses and tax-exempt organizations that carry on a trade or business during calendar year 2020 and either:

- Have operations that were fully or partially suspended during any calendar quarter in 2020 due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings due to COVID-19 (a company cannot claim the credit under this criteria if only its customers were impacted by the shutdown orders); or

- Experienced a significant decline in gross receipts during a calendar quarter.

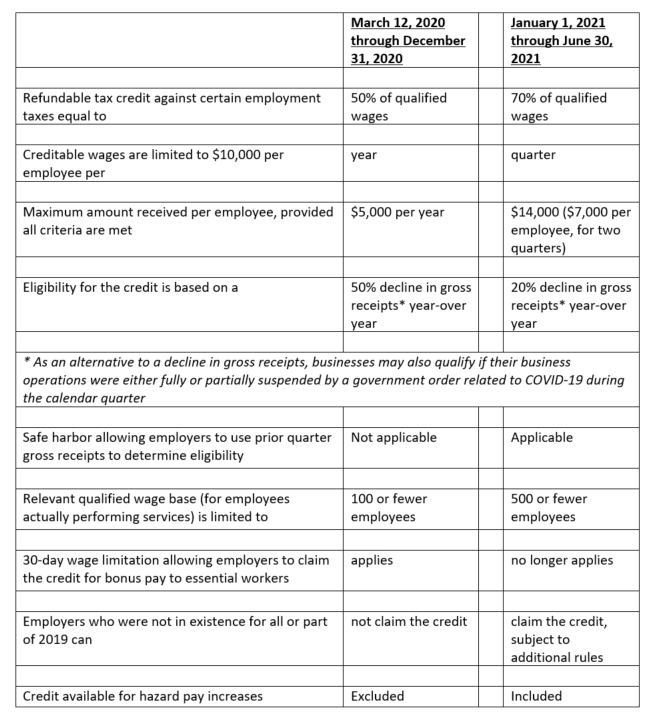

The CAA has modified many of the original provisions of the ERC as provided for under the CARES Act. With the CARES Act covering the period March 12, 2020 and before January 1, 2021, and the CAA covering January 1, 2021 through June 30, 2021, we’ve listed the provisions of the credit bifurcated by the two periods:

With the staffing industry facing many financial challenges, consideration should be given to taking advantage of PPP loans and the ERC, as there are material financial benefits available. Given the nature of COVID-19 legislation, it can be expected that additional guidance will be forthcoming. There may be tax planning opportunities to maximize the benefits of both the loan and the credit simultaneously. We recommend that you contact your advisors to discuss this further.